Garden of Life, Optimum Nutrition, Vital Proteins and NOW Foods are the top supplement brands on Amazon. In many cases, high-powered brands make high-level investments that help drive sales performance on the platform.

January 16, 2024

Garden of Life was the No. 1 supplement brand on Amazon for the 12 months ending August 2023, bringing in more than $350 million in sales on the platform, according to data from SPINS/ClearCut Analytics.

Other top supplement brands on Amazon include Optimum Nutrition, Vital Proteins and NOW Foods.

Optimum Nutrition, the second-largest supplement brand on Amazon, achieved sales of more than $300 million for the 12 months ending August 2023, per SPINS/ClearCut.

Vital Proteins and NOW Foods, the No. 3 and No. 4 supplement brands on Amazon, respectively, each brought in sales of more than $200 million for the same period, Natural Products Insider learned.

According to Daniel Harari, general manager of e-commerce solutions for SPINS, and co-founder of ClearCut, it’s not common for top supplement brands on Amazon to shift position.

“The top brands are so large now that it is rare that we see a lot of movement these days,” he said.

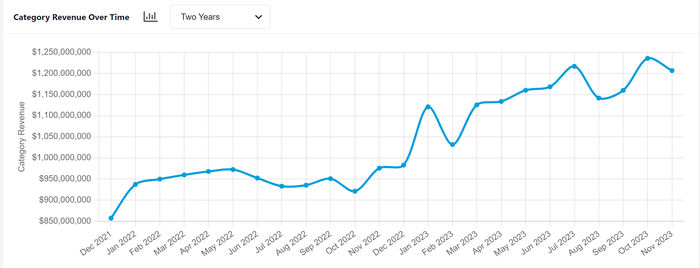

In the aftermath of the Covid-19 pandemic, Amazon is the largest retailer of dietary supplements and garners higher sales than retail giants like Target, Walmart and CVS. The online retailer brought in $12.6 billion in total vitamin, minerals and supplements (VMS) sales for the 12 months ending in August 2023, according to the SPINS/ClearCut data.

“What we have seen over the years is Amazon-first brands, like Physician’s Choice and Sports Research, became leaders in their categories and some of the largest players in the total supplement space,” Harari said.

Source for chart above: SPINS Amazon Data: Total Vitamins, Minerals Supplements, Last 24 months

Dan Richard, VP of global sales and marketing at NOW Health Group, called Amazon a “master of logistics” that provides delivery services that are “second to none.” He said NOW Foods sells large quantities direct to Amazon and also to third-party sellers who sell NOW items on the platform.

“Long-tail (or unique) SKUs sell particularly well on Amazon since many people search products by looking first to Amazon instead of Google,” Richard said in a statement.

Nestlé Health Science owns two of Amazon’s top four brands: Garden of Life and Vital Proteins.

In a statement, Moreno Perugini, president of active & medical nutrition and global pharmaceutical therapies at Nestlé Health Science, attributed the success of its top brands to the company’s efforts to deliver efficacious products that meet the increasingly high standards of supplement consumers.

“Today's consumers are more informed and discerning than ever before, with high expectations for products that deliver real results,” he said, adding the company fully recognizes and embraces these elevated expectations.

Top brands on Amazon invest heavily in the platform

In many cases, high-powered brands on Amazon are boosted by high-level investments that help drive sales performance.

According to Harari, SPINS/ClearCut classifies Vital Proteins, a collagen supplement brand, as a “level three” brand on Amazon, which means the brand uses every tool Amazon offers to grow its products.

Vital Proteins’ line of collagen products includes collagen powders, gummies, bars, waters and capsules.

“They didn't take Amazon as a passive channel,” he explained. “They took Amazon as an opportunity to grow the brand. And so now they're approaching $300 million in sales and they're growing faster than the first- and second-ranked brand in the category.”

Optimum Nutrition, Amazon’s No. 2 supplement brand, also strategically invests in its Amazon presence to grow the brand’s various product lines, Jonathan Cannizzo, Optimum Nutrition brand director, said in a statement.

“This includes a broad marketing strategy targeting active individuals and recent targeted homepage advertising placements during key drive periods showcasing products like Optimum Nutrition’s Gold Standard Whey, Creatine, Amino Energy Powders and Sparkling for heightened category growth,” he said.

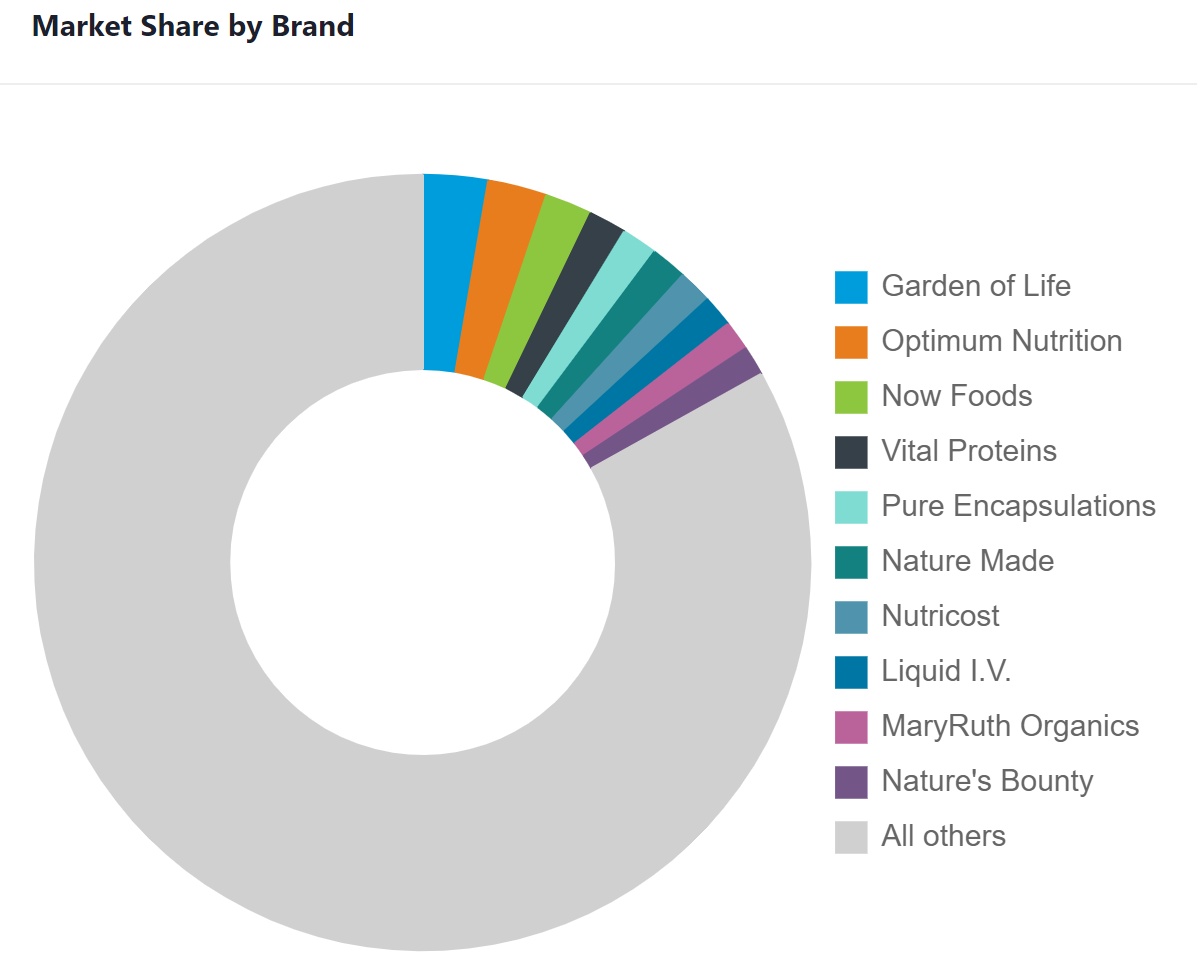

Over a 24-month period, the top 10 brands on Amazon were Garden of Life, Optimum Nutrition, NOW Foods, Vital Proteins, Pure Encapsulations, Nature Made, Nutricost, Liquid I.V., MaryRuth Organics and Nature’s Bounty, according to a pie chart below from SPINS.

Source for chart above: SPINS Amazon Data: Total Vitamins, Minerals Supplements, Last 24 months

Source for chart above: SPINS Amazon Data: Total Vitamins, Minerals Supplements, Last 24 months

High-performance brands drive category performance on Amazon

In some cases, high-performing brands are also drivers of their respective subcategory’s performance within Amazon’s larger supplements category.

Vital Proteins was the top brand in the protein and meal replacements subcategory on Amazon over the 12 months ending in August 2023, bringing in $249.1 million in sales for the category, per SPINS/ClearCut.

Since its launch in 2013, Vital Proteins has partnered with big names like actress Jennifer Aniston and social media influencer Addison Rae to promote its products. The company was acquired by Nestlé Health Science in 2021.

According to Harari, Vital Proteins’ efforts to develop and promote relevant products also played a key role in bringing collagen supplements to the mainstream.

“Collagen for years had been a category that was not very well known,” he said. “Vital Proteins identified an opportunity and essentially brought collagen to the masses and made it more of a regular everyday product that people would take.”

The whole food supplements subcategory, which took the No. 2 spot in unit and dollar sales growth within Amazon’s larger supplements category, is another that’s getting a boost from high-growth brands that invest heavily in their Amazon presence. The whole food supplements subcategory includes fruit- and vegetable-based supplements like greens powders.

Balance of Nature and Simply Nature’s Promise are two high-performing brands within the whole food supplements subcategory, each with growth over 100% for the 12 months ending in August, Harari said.

“They're investing heavily into Amazon, so that's driving a lot of the growth, most likely, for them on the platform,” he said.

Despite its successes on Amazon, one of the category’s top brands has faced some challenges. Under a consent decree of permanent injunction entered in November 2023 against Evig LLC, which distributes Balance of Nature products, the company was ordered by a federal court to stop producing and selling its products until it came into compliance with federal regulations and requirements. According to the Food and Drug Administration, the company violated current good manufacturing practice (cGMP) requirements, and some of its products claimed to diagnose, cure, mitigate, treat or prevent certain diseases, rendering them unapproved new drugs and misbranded drugs.

However, less than a week after the consent decree was announced by the government, Balance of Nature CEO Lex Howard said in a Nov. 21 news release that the company was fully operating. FDA on Nov. 21 granted Evig (Balance of Nature) authorization to resume operations after finding the company appeared to be compliant with the consent decree and the law, according to an attorney representing Evig in an email to Natural Products Insider.

About the Author(s)

You May Also Like

.png?width=800&auto=webp&quality=80&disable=upscale)