Doing good has become good business as various industries tout their better selves in highly polished commercials around giving back and honoring caregivers. But the natural products industry doesn’t have to invent a conscience that it already has.

A global lockdown might make weeks feel like months and months weigh like centuries, but business allows little room for ennui. As distracting as the daily inundation of the negative can be, the time to look forward is always now. In this new weekly feature, Informa Markets provides right-now-right-here update. Look for the Industry Health Monitor each week to learn the major news that is affecting the natural products market immediately and the less obvious insights that could dictate where the market may struggle or thrive in the months to come.

The world is changing quickly. It’s always smart to keep an eye on moving targets—even when it feels like a bull's-eye is painted on everybody and everything.

Consider this: Coronavirus crisis good for natural products industry

While a few protesters and a number of governors are ready to cut the ribbon on a national grand-reopening, a strong majority of consumers are wary that the return to normal is proceeding more quickly than cautiously. Trust in science is high, while trust in leadership varies, with the White House lagging significantly behind governors.

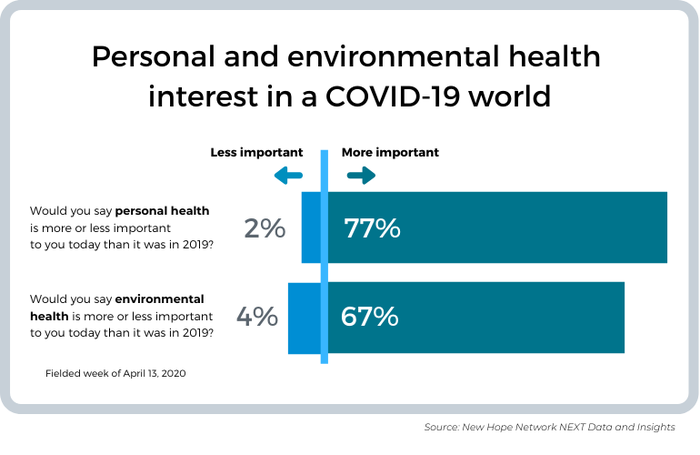

Belief in the natural products industry’s values around personal and environmental health, however, appear to be strengthening, even as an unprecedented economic uncertainty might have consumers looking more closely at personal finances than product labels.

Surveyed by New Hope Network through the Suzy research platform, 77% of consumers said their personal health was more important than it was a year ago, compared with 2% who said they were less concerned. That’s not surprising given the nature of the current crisis. Interestingly, concern about environmental health also has risen dramatically, with 67% of respondents indicating it is more important to them than a year ago and only 4% calling it less important.

This combination of high concern and a lack of faith in national leadership could be telling us that consumers will put a high value on brands that exhibit trustworthy behavior and share their concerns for personal and environmental health. Indeed, an analysis of social and mass media mentions and sentiments suggests natural products industry values and attributes are garnering more attention and regard. Reference the new weekly natural products industry enagement indexes below and watch this weekly column for weekly updates.

Analyzing consumer behavior reveals a similar pattern. Behaviors keyed to environmental/social values and nutritional quality both showed steep increases in the past several weeks, as shown on the natural products consumer behavior indexes.

Natural Products Industry Health Monitor indexes

Know this: The Amazon indexes

Informa Markets is cooperating with Netrush, a retailer that partners with natural products brands on Amazon, to create a weekly index score. The index aims to provide a snapshot view of consumer trends in various CPG product categories on the Amazon marketplace.

The most recent index scores suggest that the pantry stocking phase of the pandemic characterized by "panic buying" and "pantry loading" has started to recede, but new shopping patterns may be emerging. The daily index suggests that purchases of less frequently restocked items in the health and household department are slowing, but that online purchases of grocery items continues to grow.

Listen to this

Coronavirus cause and effect. It’s easy to get caught up in the headlines and the dark statistics of the daily death toll, but the natural products industry should also be looking at the prospect of a societal “reset,” with people taking a new look at what’s important to their lives, their families and their communities. In the New Hope Network State of Natural and Organic webinar, Whipstitch managing partner Nick McCoy called out seven “silver linings” to the crisis. “Increased Focus on Wellness” is obvious, but “Land Conservation” and “Increase in Community” may be more than just dreams.

McCoy's seven silver linings on the other side

1. Increased Focus on Wellness. Already seeing in immunity purchases, will expand across entire sector as immunity focus translates into healthier food and beverage habits.

2. Move Away from Individualism. New investments in public good, for health especially, and public services.

3. Expansion of Online. Rethink the kinds of community we can create through devices.

4. Domestic Self-sufficiency. Supporting the domestic production in all sectors to reduce or eliminate needs for imports.

5. Land Conservation. Realization that consumption of land for industrial purposes crams animals together, spreading disease.

6. Post-crisis Boom. Based on 1918 flu, people will seek relief from stress, pleasure and a search for community.

7. Increase in Community. We as people are helping others at macro, micro and all levels in between at high levels not seen before COVID-19. Our industry can benefit from increased collaboration.

Check out the complete State of Natural and Organic webinar presentation.

Stop the claims before they start. Dietary supplement trade associations have consistently applauded FDA actions against brands making claims specific to COVID-19 prevention and treatment, but a Department of Homeland Security statement that supplements are “essential” businesses alongside pharmaceuticals and medical equipment raises the onus on responsible brands to call out irresponsible statements. “People will take advantage of that upgrade, and somehow convince themselves ‘Great, we can make stronger claims. We can talk about COVID-19,’” says United Natural Products Alliance President Loren Israelsen in a NewHope.com article on the industry's quest to find credibility in the crisis. “That’s something that requires our collective vigilance is to slap that down if we see anything like it.”

Industry (and consumers) need innovation. With grocery stores standing as one of very few destinations of commerce, natural products brands have if nothing else captured the attention of consumers. We’re also seeing reports of “recipe fatigue” popping up in social media. Both of those things suggest consumers will be ready to see innovation when brands are prepared to make the pivot from “what now?” to “what’s next?” In an interview with Food & Beverage Insider, Go Big CEO Ben Koren said consumers will be chomping at the bit for something new. “Grocery stores are generally crushing it right now, but their entire innovation cycle has been completely disrupted, or interrupted rather, so new products are really not going to be coming to market for a number of months later than when they were going to. So we think there's actually a huge, pent-up demand right now for new innovative products.”

Enjoy this

When grocery shopping becomes a coveted excuse to get out of the house, we can expect all manner of new consumer behaviors. At some point “panic buying” becomes “boredom buying,” or perhaps “warm fuzzy blanket to hide under until this is all over” buying.

Methodology footnotes

Netrush’s Amazon indexes: The index score is based on performance of top products in Amazon’s health and household; beauty and personal care; grocery and gourmet food; baby; and pet supplies categories. Products are chosen based on their age and position in their respective categories. Total estimated orders are estimated based on historic “Amazon Best Seller Rank” data and other factors, and the score is weighted by float-adjusted total orders.

Natural products consumer behavior indexes: NEXT Data and Insights survey of n~1,000 collected weekly March 30-April 20, 2020, using a convenience sample directionally representative of U.S. consumers ages 18-65 weighted for age, region and gender. The 2017 survey data are based on responses of 1,000 people nationally representative of the U.S. adult population. Index tracks “top two box” responses.

Natural products industry engagement Index: NEXT Data and Insights tracks the core 50 trends defining and innovating the natural products industry. By filtering social and mass media listening through these top trends we are able to track weekly indexes of total mentions and Net sentiment of the hot topics representative of the industry from the beginning of March 2020 compared to average weekly scores of the last three months of 2019. This allows stakeholders a view into the pulse of the industry through online conversations.

About the Author(s)

You May Also Like

.png?width=800&auto=webp&quality=80&disable=upscale)