Consumers are interested in dietary supplement ingredient transparency, but supply chain intricacies and business taboos can make disclosure difficult.

Insider Takes

Most consumers—and the supplement industry at large—are interested in increased transparency.

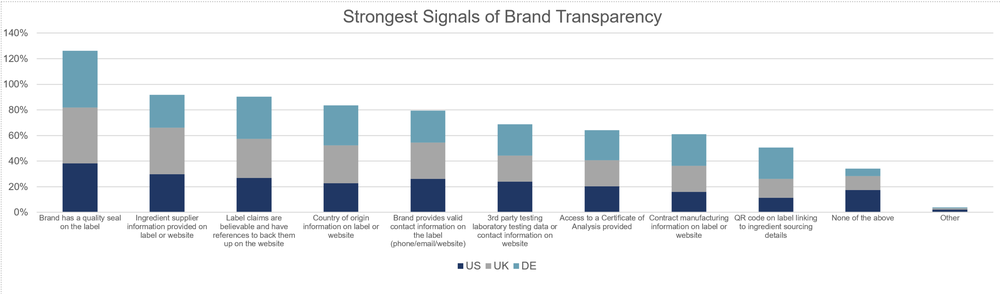

Consumers in the U.S., UK and Germany rank quality seals as the most popular method of transparency.

Manufacturers often withhold the identity of their ingredient suppliers to leverage those relationships.

The word transparency is thrown around in many industries—most accept consumers are looking for “it.” In recent dialogue with companies in the supplement industry, Trust Transparency Center described transparency as a journey that every company is on; there’s a destination, which is “increasing transparency,” and each organization is at a different way-station.

Considering the dietary supplement industry as a whole, it too is on a transparency journey, with a similar destination—increased transparency.

Despite the common goal, it’s possible to become disappointed and frustrated with slow progress.

Transparency signals

In surveying dietary supplement consumers in the U.S., UK and Germany, Trust Transparency Center determined when consumers were looking for signals of transparency, a quality seal was deemed the most important variable in all three countries, followed by ingredient supplier information in the UK and U.S., and in Germany, believable label claims with references.

Country of origin also scored high in all three countries (3rd in Germany, 4th in the UK and 6th in the U.S.).

Source : Trust Transparency Center ITC Insight – 2020 Consumer Survey

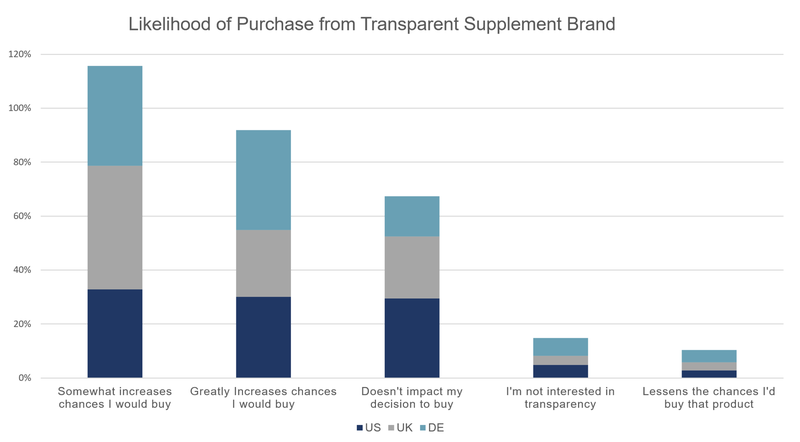

Furthermore, in all three geographies, consumers indicated more transparency information would either somewhat or greatly influence their buying decisions. The sentiment was very strong, especially in the UK and Germany.

Source: Trust Transparency Center ITC Insight – 2020 Consumer Survey

Beyond the consumer: The black box?

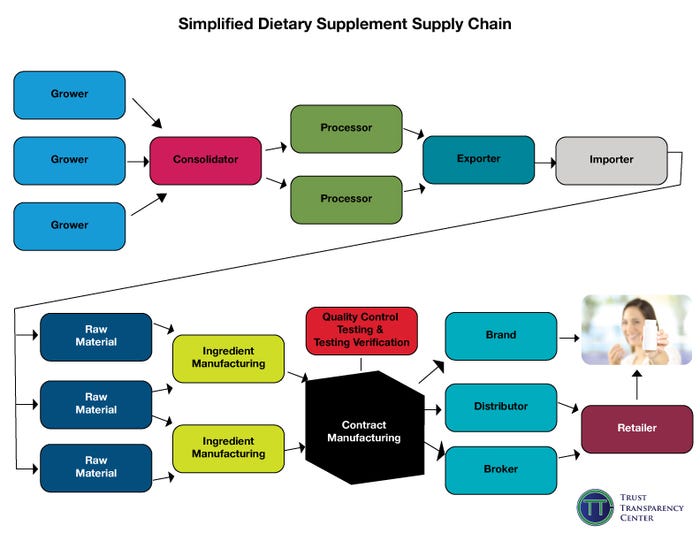

When considering transparency at brand level, consumer perception is only part of the picture—as real supply chain transparency goes deeper and is far more complex.

Source: Trust Transparency Center.

In the dietary supplement space, supply chains can become quite convoluted.

The black box indicates contract manufacturing. At this stage of the supply chain, it can become blocked in both directions, a significant problem for accountability and risk management.

For instance, while a brand with its own in-house manufacturing can stipulate a proprietary ingredient and see it through formulation and marketing, a brand relying on contract manufacturers relies entirely on that facility’s sourcing, testing and other compliance processes.

Naivety within this space is a huge problem. Unfortunately, many emerging brands often don’t know what they don’t know.

The gatekeepers?

It is common for newer brands to completely bypass brick-and-mortar retail and even fundamental industry 101 education. In these cases, the contract manufacturers become the true gatekeepers of the supply chain—which is fine for those with high standards, but for those shops that operate on tight margins, extremely low minimums and reverse engineering of the most popular formulas, there are many motivations to be opaque.

Increasingly, consumers want to know more about how and where products are made and how supply chain decisions are determined. They also want to know if, for instance, synthetic ingredients are in their products.

This is a huge transparency issue, and one that industry seems reluctant to deal with.

Ingredient supplier quandaries

Delving deeper into the supply chain and implications of lack of transparency, ingredient companies deal with frustration, too.

While accountable under regulations, they have limited control over the final disposition of their ingredients. Even while selling innovative, substantiated ingredients, the actual purchasing decision can be quite convoluted in commonly complicated chains.

Questions ingredient suppliers face include whether to:

Pitch to emerging brands

Deal solely with the contract service providers who may be motivated to use less costly (less researched or validated) materials

Sell exclusively through contract manufacturers, thereby seriously limiting downstream transparency and impact

Manufacturers often hold their sources of supply extremely close, leveraging relationships and other business rationale.

Frequently, they (and brands) want backup suppliers or to keep options open.

Downstream quality

From an ingredient sourcing standpoint, increased requirements for assuring quality downstream through regulatory requirements like the Food Safety Modernization Act (FSMA) have put pressure on ingredient distributors to be more transparent about source and condition of supply.

While mandated in part by regulations, that part of the chain too is still hazy with distributors fearing disintermediation, or they have built businesses based on proprietary relationships they are loath to publicize.

Amazon introduced country-of-origin declarations, others have used QR codes and other platforms to give visibility on farmers, sourcing and supply, but at this point, many of the players resist too much disclosure, whether that be primary suppliers, contract manufacturers or even the contract analytical labs they use.

Additionally, adulteration has seen an uptick as ingredient scarcity hits supply chains. Could the impact of recent highly publicized warnings and recalls have been mitigated by enhanced transparency?

Taking a look at the FDA recall associated with products produced by ABH Pharma, one can’t help but ask if a more transparent environment would have minimized damage to brands whose entire lines were suddenly de-listed by Amazon in the aftermath, even if only a single SKU was made by ABH.

It remains obvious that there is not enough market and commercial pressure to change behaviors, despite numerous industry initiatives and calls to FDA to do more.

This begs the question—what’s it going to take? Some call for additional enforcement, others for more gatekeeping at retail or e-tail.

Carrots and sticks

Any solution must demand accountability, while rewarding best practices and punishing deliberate lack of transparency.

Private label brands are trying to be more transparent, recognizing the opportunity, but also more fully controlling their supply chains, and ultimately this may help them compete.

Elsewhere, the full rewards of transparency are inadequate—transparency collisions are bound to occur, resulting in a significant erosion in consumer confidence that will cost millions, for individual brands and for the category.

Hopefully the fallout is contained and the resulting scandal eliminates the poorer elements. Somehow though, they are often the survivors—industry can’t let that happen.

Len Monheit has been in the industry for 20 years, initially as a co-founder of digital media leader NPIcenter, which was sold in 2006 to New Hope Natural Media. As part of New Hope’s senior leadership team, Monheit assumed responsibility for digital media operations, then the ingredient portfolio of Functional Ingredients, Engredea and Nutracon. He initiated international market preparation workshops in Japan, China and India, and market analysis as part of Nutrition Business Journal (NBJ) and the NEXT insights platform. Monheit has guided ingredient and supplement companies on strategy, and speaks globally on topics such as ingredients, the supplements market, supply chain, sourcing and emerging trends. He is currently CEO of Trust Transparency Center.

About the Author(s)

You May Also Like

.png?width=800&auto=webp&quality=80&disable=upscale)